retroactive capital gains tax hike

The 1987 capital gains tax collections were slightly below 1985. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

A New Era In Death And Estate Taxes

The retroactive aspect of the tax hike is a tacit admission that such a large tax hike is likely to change investor behavior as taxpayers seek to avoid paying such an elevated rate.

. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act. A natural reaction to a looming tax hike is to sell quickly before the new law takes effect. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

On The Retroactive Capital Gains Tax Hike. Im not freaking out but I cant just put my head in the sand. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive. The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013. With this retroactive income tax hike the White.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that wouldnt count as a retroactive increase. The expectation of this increase resulted in a 40 increase in the amount of tax collected on. This resulted in a 60 increase in the capital gains tax collected in 1986.

Signed 5 August 1997. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the.

Most of the other increases if. 10534 Introduced 24 June 1997. Top earners may pay up to 434 on long-term.

Capital gains on investments can result in triple-taxation. Legislation Timing Rate Change Rate Changes Taxpayer Relief Act of 1997 Pub. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

If you add state taxes like Californias current 133 rate the government gets most of your gain. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase.

I dont see a prospective change in rules pertaining to the taxation of future realization of capital gains as being a retroactive feature Yellen told the Senate Finance. This would prevent wealthy people from quickly selling off their assets before the end of the year to avoid the hike. Then there is timing.

Critics of the plan say it will hurt investment and economic growth by penalizing gains.

Canada Child Benefit The Hidden Tax Rate Planeasy

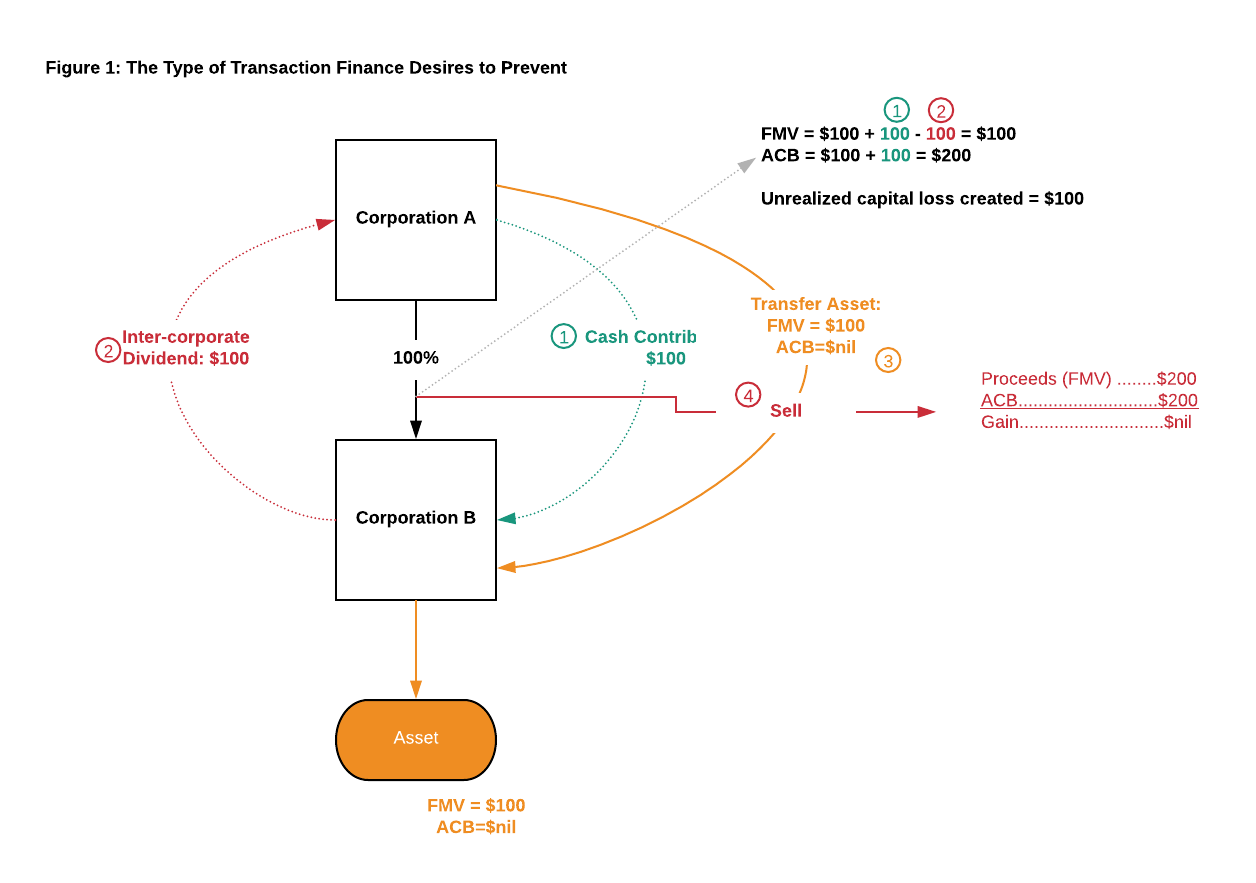

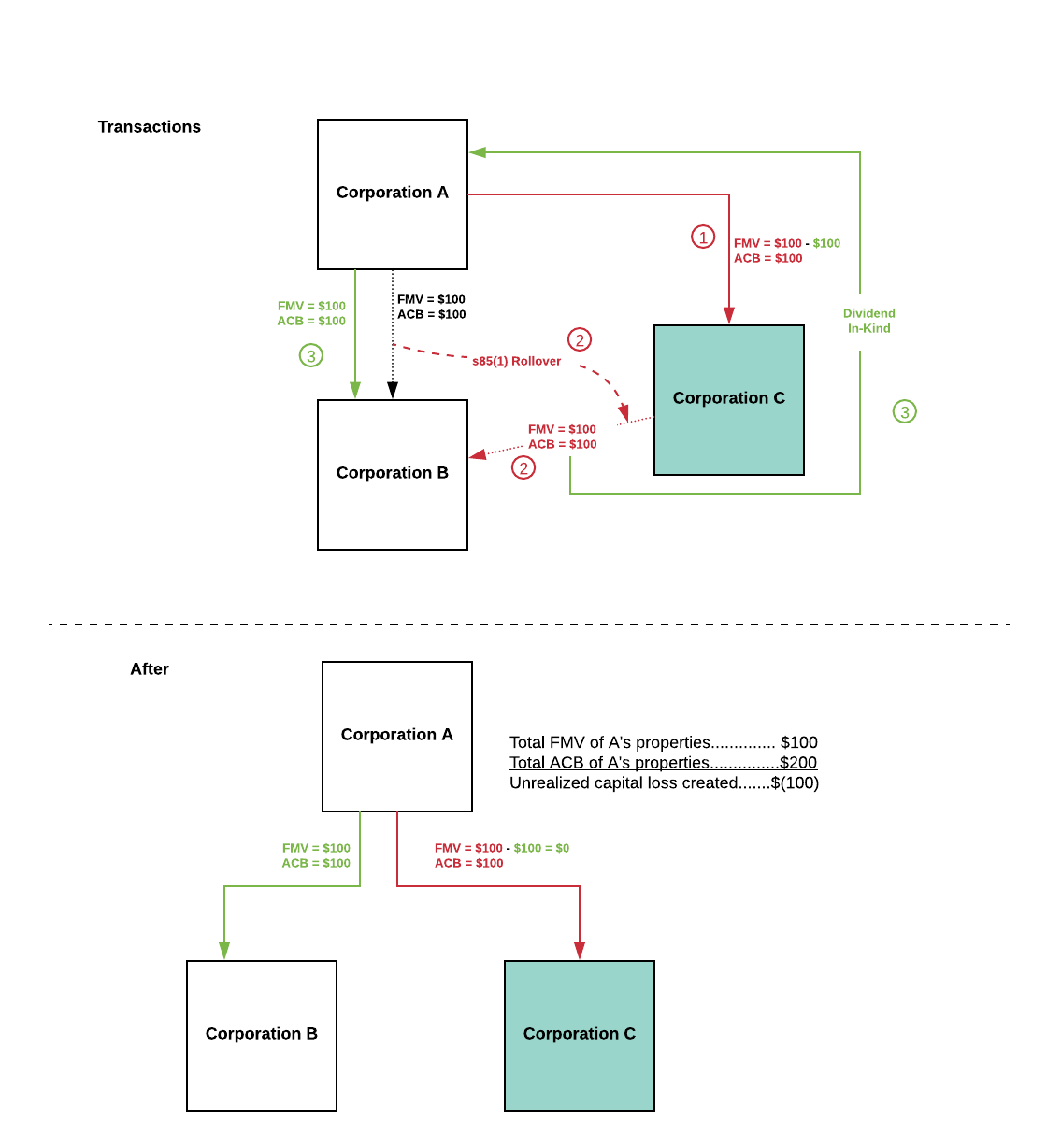

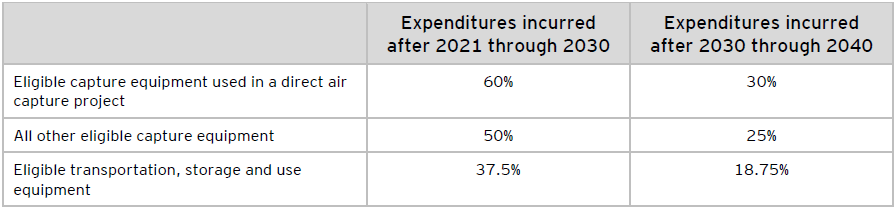

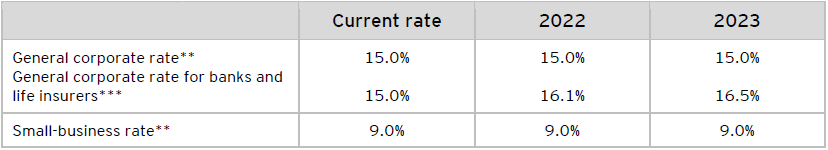

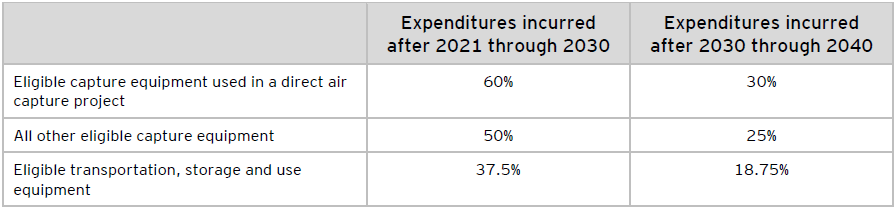

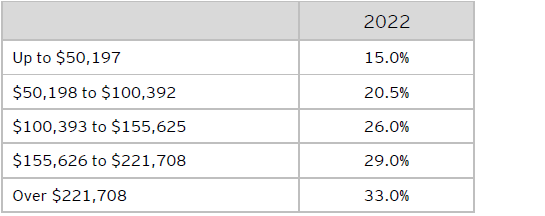

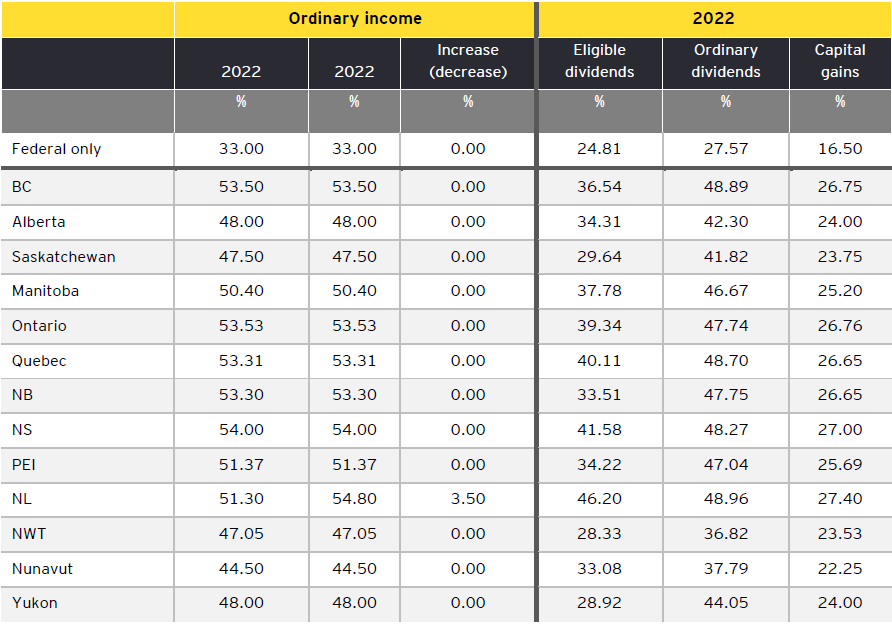

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Manchin Signals Support For Human Infrastructure Measure Nudging Up Corporate And Capital Gains Tax

A New Era In Death And Estate Taxes

How To Arrive At The Indexation Of Your Property To Calculate The Long Term Capital Gains Tax Quora

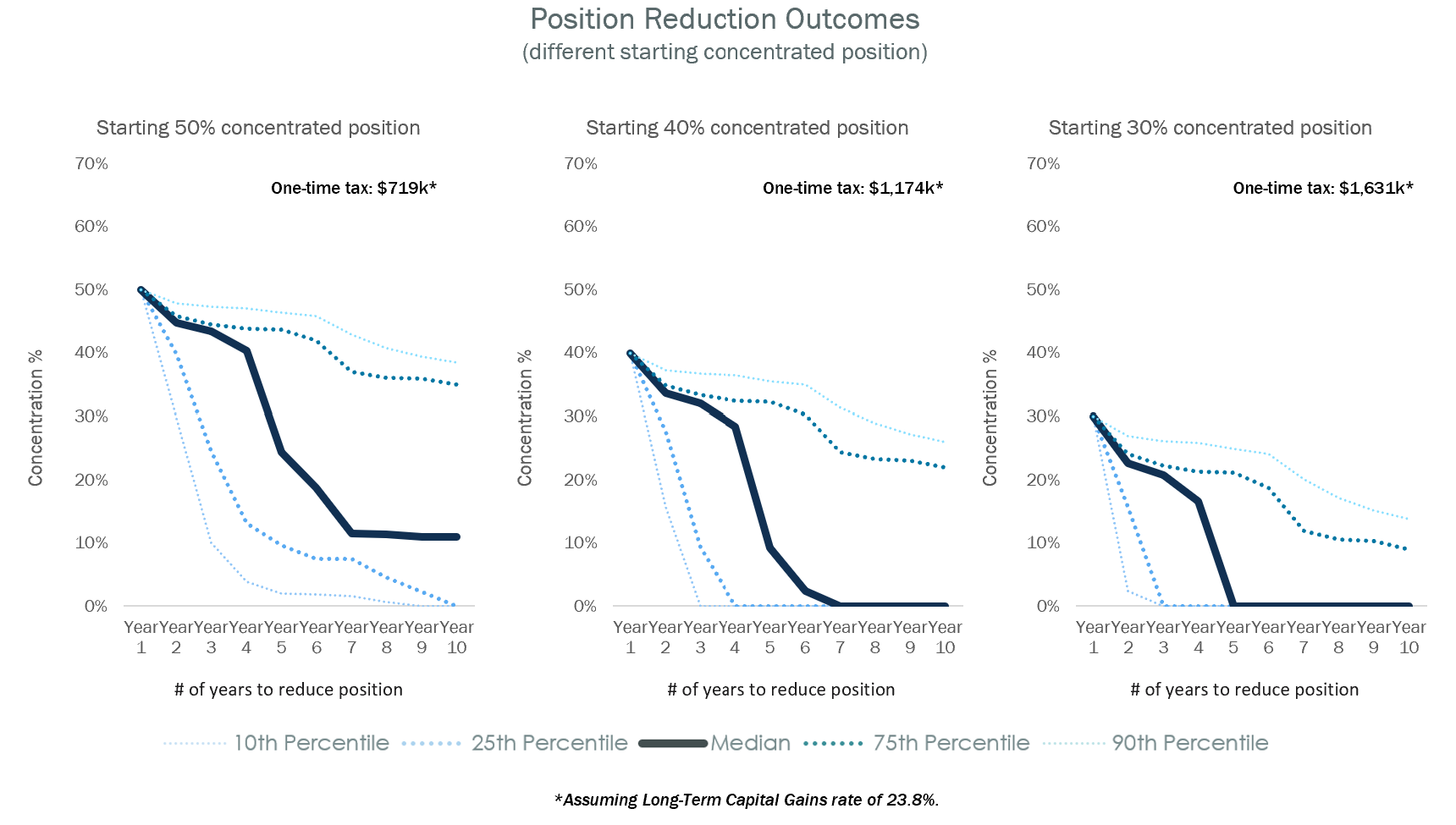

The Concentrated Stock Puzzle O Shaughnessy Asset Management

Tax Prep Checklist What Documents Do I Need To File Cansumer

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada

Why This Entrepreneur Wants You To Be A Millionaire

How To Calculate Capital Gains Tax On Property Quora

Congress And Biden Can Raise Taxes Retroactively If They Want To The Washington Post

Ey Tax Alert 2022 No 23 An Engine For Growth Federal Budget 2022 23 Ey Canada