does kansas have an estate or inheritance tax

Kansas Inheritance and Gift Tax. The state income tax rates range from 0 to.

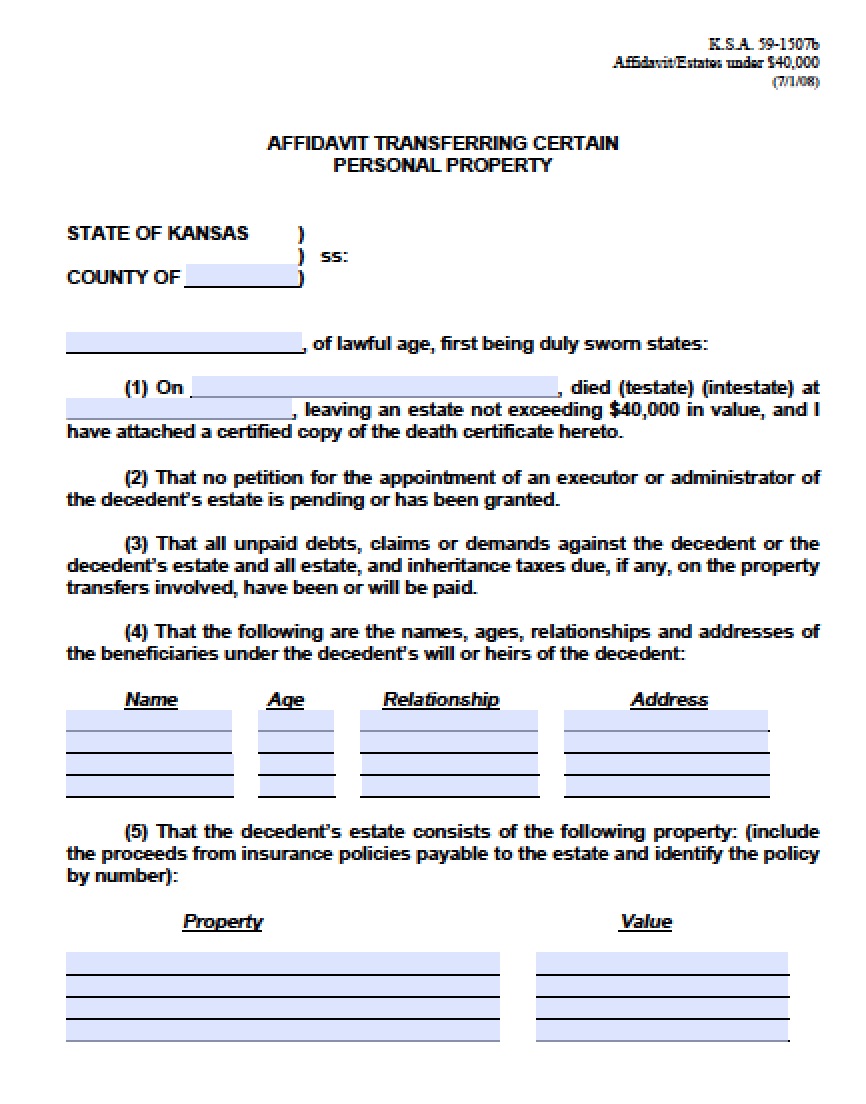

Free Kansas Small Estate Affidavit Form Pdf Word

The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs.

. Kansas requires you to pay taxes if youre a resident or nonresident who receives income from a Kansas source. Exemption levels rise to 12 from 7. Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570.

The state sales tax rate is 65. The top estate tax rate is 16 percent exemption threshold. States That Have Repealed Their Estate Taxes.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. No estate tax or inheritance tax. Kansas does not collect an estate tax or an inheritance tax.

A federal estate tax is in effect as of 2020 but the exemption is significant. Kansas does not levy an estate tax making it one of 38 states without an estate tax. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance. In Pennsylvania for instance the. The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax exemption from the total value of the estate.

Delaware repealed its tax as of January 1 2018. Delaware repealed its tax as of January 1 2018. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

Some states have inheritance tax some have estate tax some have both some have none at all. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Another states inheritance laws may apply however if you inherit money or assets from someone who lived in another state.

Does kansas have an estate or inheritance tax. Just five states apply an inheritance tax. Both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

The inheritance tax applies to. Massachusetts and oregon have the lowest exemption levels at 1 million and connecticut has the highest exemption level at 71. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

The top inheritance tax rate is18 percent exemption threshold. This increases to 3 million in 2020 Mississippi. No estate tax or inheritance tax.

Kansas Estate Tax. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Kansas has no inheritance tax either.

No estate tax or inheritance tax. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

While each state sets its own laws regarding inheritance taxes the majority of us. However if you are inheriting property. Seven states have repealed their estate taxes since 2010.

Does kansas have inheritance tax.

Options For Transferring Property Outside Of Probate In Kansas

Kansas Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Kansas Inheritance Laws What You Should Know

Kansas Estate Tax Everything You Need To Know Smartasset

Retiring In These States Will Cost You More Money Vision Retirement

Kansas Estate Tax Everything You Need To Know Smartasset

Free Kansas Small Estate Affidavit Form Pdf Word

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Kansas Estate Tax Everything You Need To Know Smartasset

State Death Tax Is A Killer The Heritage Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Here S Which States Collect Zero Estate Or Inheritance Taxes